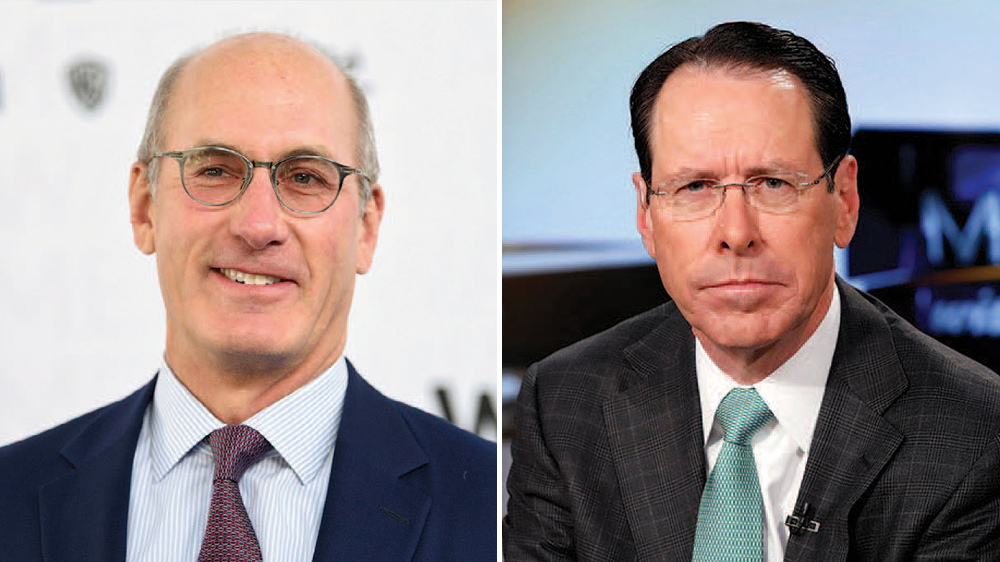

With John Stankey as New CEO, AT&T Looks to Stay the Course Following Randall Stephenson’s Surprise Exit

By Elaine Low

LOS ANGELES (Variety.com) – The announcement Friday that AT&T CEO Randall Stephenson would be handing over the reins of the major telecom and media company, after 13 years at the helm, took industry watchers by surprise. But longtime lieutenant John Stankey’s assumption of the role at the start of July means that the changing of the guard — however unexpected — doesn’t point to much of a shift in the strategic direction of AT&T as it attempts to enter the highly competitive direct-to-consumer streaming entertainment market.

“It almost by definition doesn’t change anything,” says MoffettNathanson equity analyst Craig Moffett of the leadership transition. “Staying the course means you’re still going to try to create the modern media company, where proprietary content is produced by one part of AT&T and distributed by another.”

Stankey, who has served as the company’s chief strategy officer and chief technology officer, as well as chief exec of AT&T’s entertainment group, operations and business solutions units at various points, has been with the company since 1985. He ascended to president and chief operating officer of AT&T last fall.

But the timing of the transition raised a few eyebrows; Stephenson had as recently as February told CNBC that he planned to stay on board as chief executive through the end of calendar 2020. It isn’t clear why the executive shuffle happened when it did, or how much the ongoing public health crisis or recent new hires played into the decision. Hulu co-founder and ex-CEO Jason Kilar was named CEO of WarnerMedia at the start of April, succeeding Stankey as of May 1.

Most executive appointments do not prompt commentary from the White House, but President Trump tweeted Friday that the changeover was “great news!,” speculating that Stephenson was possibly forced out, despite there being no indication that such was the case. (Trump’s online griping appeared to be rooted in AT&T’s ownership of CNN.)

AT&T is not the only major company with media holdings to make a surprise change in leadership this year. Disney in February announced that theme parks head Bob Chapek would immediately succeed longtime Disney chief exec Bob Iger as head of the conglomerate, well in advance of the end of Iger’s contract. That regime change, which occurred just weeks ahead of the coronavirus outbreak hitting U.S. shores, has proved interesting to watch unfold. Though Chapek is technically CEO, it is the familiar face of Iger — now executive chairman — that has been shepherding the company through the crisis and working on California’s economic task force with Gov. Gavin Newsom.

But Stankey’s ascension announcement seemed deliberate, even with the country in the thick of the pandemic, and his first day as CEO in July will come as many states make an attempt to get back on track. The virus’ severe global economic impact has not left AT&T unscathed, reducing the company’s first-quarter earnings by $433 million.

What remains clear is the company’s commitment to fortifying its place in the entertainment world. WarnerMedia holdings include Warner Bros. film and television studios; DC Entertainment; a bevy of cable networks that include HBO, TNT and TBS and Turner Sports — and the much-anticipated HBO Max streaming platform, which will arrive on May 27.

Moffett says that AT&T’s most important business, its “center of gravity,” remains its telecom division. But Stephenson underscored his focus on building out the streaming service in AT&T’s annual report, released April 24, calling the traditional Hollywood model “unsustainable.”

“The old business models in which premium content is created for distribution exclusively through such traditional channels as theaters, cable and satellite companies just aren’t sustainable,” he wrote. “Technology is driving these business models together, and we believe those companies that can integrate scaled content creation businesses with scaled distribution will hold a critical advantage in the years to come.”

AT&T’s approach with HBO Max, described by Stephenson in the annual shareholders’ meeting as aggressive, is designed to net 36 million customers this calendar year and 50 million by the end of 2025.

At this stage, the change to the economic climate is perhaps likelier to have an impact on AT&T’s traditional entertainment operations and direct-to-consumer space than a change in executive leadership. As Stankey said on the first-quarter earnings call, the company is “rethinking” its theatrical model, but thus far is planning to stay the course on the production end.

“The studios are dark for now, but as soon as we can resume production, we plan to get back where we left off in March with the steady stream of new offerings in the fall and winter,” he said. “We are also deep into planning how priority operations will return to the workplace as we come out of this pandemic. This experience will change many things, including customer behaviors and expectations.”

Adding that AT&T will “weather the storm,” Stankey promised that the company would work hard to “come out of this crisis stronger than before.”