Weinstein Co. Creditors Fume About $23 Million Price Cut

By Gene Maddaus

LOS ANGELES (Variety.com) – The Weinstein Co. bankruptcy has gone relatively smoothly so far. But things are about to get heated, as the company agreed last week to cut its sale price by $23 million.

In a conference call on Monday with Judge Christopher Sontchi, the attorney for the committee of unsecured creditors blasted the company and acquirer Lantern Capital for agreeing to the reduction.

“This is just a money grab,” said the attorney, Robert Feinstein. “There is no principled reason to agree to a purchase price adjustment as large as they did.”

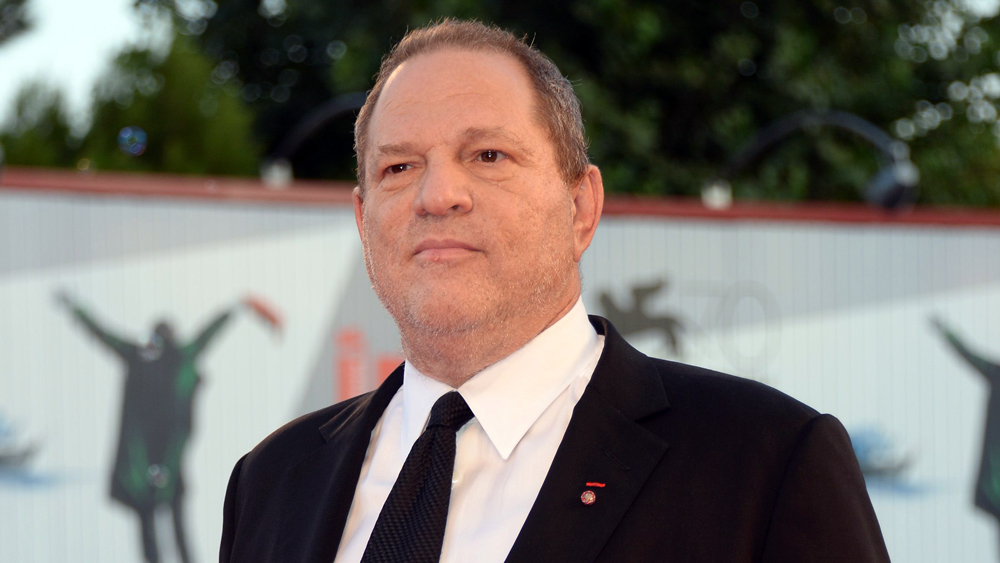

The creditors committee represents Harvey Weinstein’s alleged sexual misconduct victims as well as the company’s trade creditors. The reduction will come out of any recovery that may be available for those creditors. The committee is now preparing for a contentious hearing on July 11 to decide whether the reduction should be approved. If it is not approved, there is a risk that Lantern will walk away, sending the company spiraling into liquidation.

Monday’s hearing was intended to bring Sontchi up to speed on the case, which he will handle while Judge Mary Walrath is on vacation. Paul Zumbro, the attorney for the Weinstein Co., gave a little more explanation for the price reduction than had previously been offered.

According to Zumbro, much of the issue deals with backend profit participation payments that are owed to actors and directors on various Weinstein projects. Quentin Tarantino, for example, has alleged that he is owed $2.5 million for various films. According to Feinstein, the total amount of such payments in dispute is roughly $26 million.

Lantern and the Weinstein Co. have been fighting over who is responsible for those payments. The Weinstein Co. agreed to the price reduction in order to keep Lantern from backing out of the deal.

“The debtors believe we have no better alternative,” Zumbro said, warning that not agreeing to the reduction would “risk a meltdown or liquidation scenario.”

Feinstein alleges that Lantern has contrived a number of other alleged issues, which, taken with the participation fees, totals $52 million. Feinstein argues that Lantern is taking advantage of the Weinstein Co.’s desperation to close the sale, and that Lantern should have been aware of the issues through its due diligence before agreeing in March to buy the company for $310 million.

Feinstein said the committee would take “hostile” depositions of the Lantern and Weinstein Co. officials in preparation for the July 11 hearing.