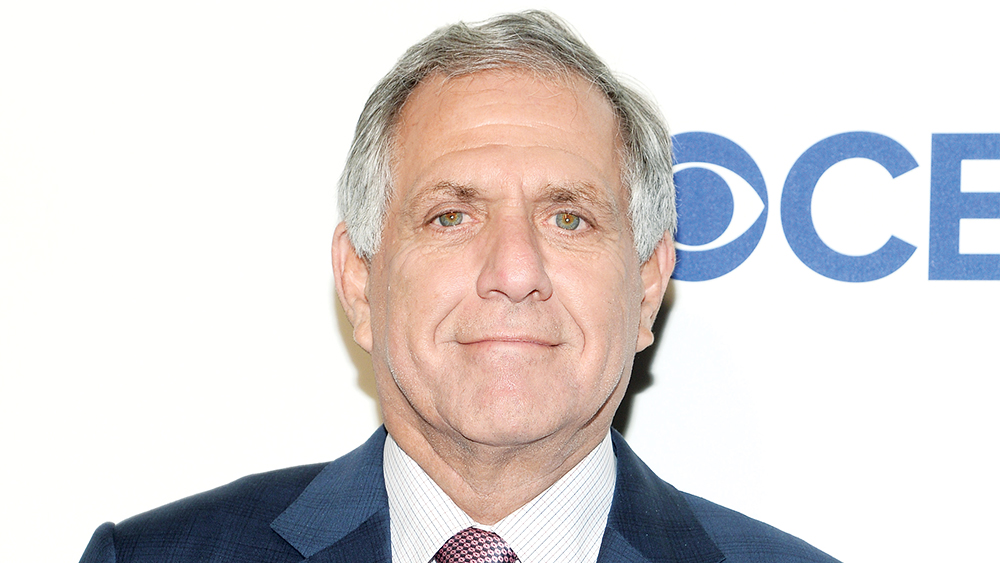

Wall Street Sees ‘Cloud’ Over CBS Until Leslie Moonves Situation Resolved

By Brian Steinberg

LOS ANGELES (Variety.com) – Shares of CBS Corp. began to climb back upwards Tuesday, but Wall Street still believes a bizarre soap opera engulfing the company’s legendary CEO threatens to drag them down.

CBS’ board of directors on Monday decided to keep Leslie Moonves, the company’s executive chairman and CEO, in place even as it took steps to investigate allegations that he forced unwanted sexual contact on six different women who made details about their encounters with him known to The New Yorker. Moonves in a statement to the magazine that “I recognize that there were times decades ago when I may have made some women uncomfortable by making advances. Those were mistakes, and I regret them immensely.”

Keeping Moonves in place may only delay some very tough decisions for CBS, analysts believe. “This is a cloud,” said Tuna Amobi, a media-industry analyst for CFRA Research, noting that CBS has also opened an investigation at CBS News to examine allegations of harassment and workplace culture. “I think it’s fair to say that investors want this to go away, but that’s not how these things get resolved.”

Shares of CBS in Tuesday-afternoon trading rose 2.38%, or $1.22 per share, on higher than average volume of 8,733,950.

The board has expressed faith in the current CBS management team, and many analysts concur that Moonves and his senior executives have generated a lot of value over the years. But some fear the allegations, part of a broader “MeToo” movement that has sought to redress many past harassment incidents and resulted in the ouster of senior media figures including Harvey Weinstein, Matt Lauer and Charlie Rose, may make Moonves’ position at CBS untenable.

“The company will not be viewed by many key industry participants as taking workplace safety seriously without significant action, which we think the Board will realize has commercial consequences, if not legal and moral ones,” said Brian Wieser, a media analyst with Pivotal Research in a Tuesday note to clients. “Consequently, it seems likely to us that CEO Les Moonves will be eventually removed from his role.”

Dismissed the CEO, however, will not calm the swirl around CBS. The company is in enmeshed in a bitter legal battle with its controlling shareholder, National Amusements Inc., led by Shari Redstone. CBS wants to dilute NAI’s control, the pushback to what is said to be a belief that Redstone wants to merge CBS and NAI’s other holding, Viacom, and assert more control over the direction of both corporations. The squabble has erupted at a time when many content producers are merging or combining with larger technology concerns. What’s more, CBS has delayed its annual shareholders meeting for a second time, and has not set a new date for the event.

Investors will no doubt hope to glean more detail about how the CBS board will proceed by analyzing the company’s second-quarter earnings report, due out Thursday afternoon. Even at the stock’s current levels, said Amobi, “it is still trading at a modest premium to some other media companies and at a significant premium to .” CBS may be smaller than many of its rivals, but investors have been attracted to Moonves’ strategy of trimming the company’s depending on advertising revenue and increasing the cash it gets from international licensing, streaming and retransmission fees. “You’d be hard-pressed to find an investor that thinks Leslie hasn’t done a remarkable job in the past decade, but the issue at hand now is rising above the fundamental outlook for the company,” said Amobi.

CBS did not respond immediately to a query asking if Moonves would be present during the company’s second-quarter conference call with analysts and investors.

In the end, Moonves’ fate may well hang on the 11 independent members of the company’s board, who are said to be focused on CBS’ workplace culture as well as investigating the recent allegations against the CEO. “They need to do their own work and make a thoughtful decision,” says Laura Martin, an analyst with Needham & Co. But the board also has a fiduciary responsibility to shareholders that makes it difficult to bid Moonves farewell. If the board independently confirms the New Yorker allegations, Martin says, “it likely means will gain more leverage in her efforts to combine Viacom and CBS, which is sub optimal for CBS shareholders.”