Sumner Redstone Trust ‘Bombshell’: Ownership Provision Comes to Light in CBS-NAI Hearing

By Cynthia Littleton

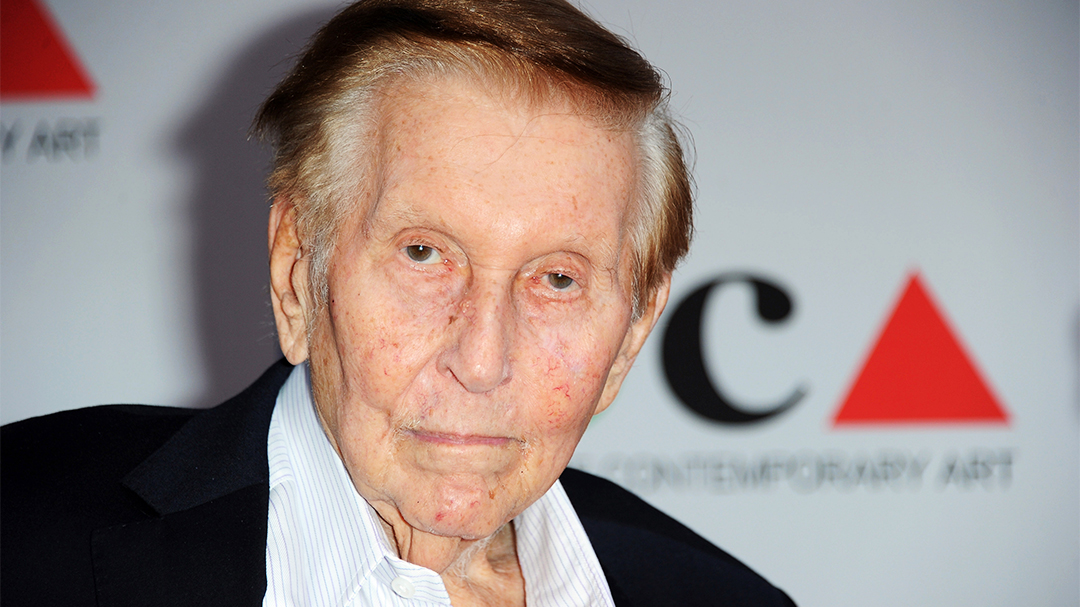

LOS ANGELES (Variety.com) – Even after his death, Sumner Redstone sought to ensure that his heirs retain a significant stake in CBS Corp. and Viacom.

A provision in the trust agreement that will govern Redstone’s controlling stakes in and after his death is designed to put some restrictions on sale options for CBS and Viacom by stipulating that the trust must maintain at least 30% of the voting interest in the resulting entity in the event of a sale, according to multiple sources. That would make it difficult for CBS or Viacom to be acquired by a significantly larger entity.

The provision came to light during an exchange between lawyers on Wednesday in Delaware Chancery Court, where CBS and Redstone’s National Amusements Inc. are battling over CBS’ lawsuit challenging NAI’s control of CBS Corp. The suit is a byproduct of the battle between CBS Corp. chief Leslie Moonves and NAI president Shari Redstone over the future of CBS and CBS’ resistance to reuniting with Viacom.

CBS is challenging Shari Redstone’s ability to act on behalf of her father, arguing that the ailing is not capable of making decisions and never explicitly transferred his interests in NAI to his daughter, Shari Redstone, who owns about 20% of NAI while Sumner Redstone owns the rest. Shari Redstone is vice chair of CBS and Viacom, both of which are controlled by NAI. NAI itself is governed by a seven-member board, of which Shari Redstone is a member.

Attorney Joseph Allerhand, representing the independent members of CBS’ board of directors in the lawsuit, referred to the trust provision during an exchange before Judge Andre Bouchard. Allerhand raised the specter of the trust provisions being a concern for investors in CBS and Viacom, because those investors have not been made aware of the constrictions around a sale following Redstone’s death or incapacity.

“There are terms in the trust which I think are fairly described as bombshells, if the public knew about them,” Allerhand said.

NAI attorney Meredith Kotler acknowledged the provision — although she did not spell out the specifics — but argued that it was not significant because the trustees of the Sumner Redstone trust could vote to amend those terms.

“If they think that provision would preclude the trustees after Mr. Redstone’s lifetime from doing something, they’re wrong about that, because the trustees can amend it,” Kotler said. “There’s no bombshell, nothing big, nothing special. We weren’t even going to raise it, but they had raised to you this question: does the trust allow this? And how important this is. And all we said is, no, it doesn’t preclude it. No bombshell.”

CBS is expected to file a motion soon to address the trust provision in more detail. CBS lawyers have also complained that they have not been able to review the trust in full. Allerhand told the judge that only “a select group of 11” people have been allowed to review the terms of the trust, and none of them are tied to CBS.

“We have to let CBS’ general counsel and other people have access to this. These aren’t personal family issues. These are issues that go to what happens to the CBS stock. People have to know this,” Allerhand said.

Reps for CBS and NAI declined further comment.