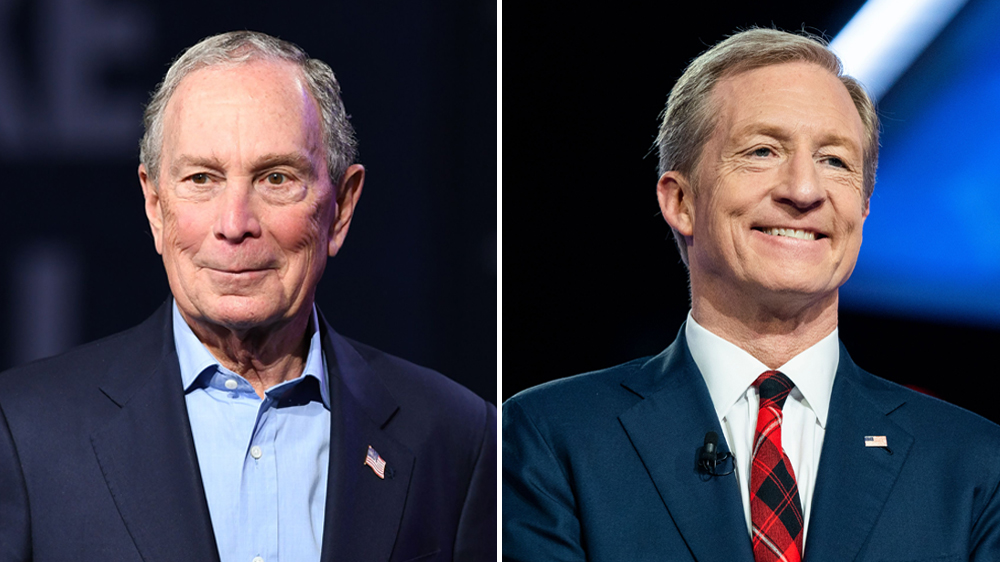

Mike Bloomberg and Tom Steyer Delivered $600 Million Windfall to Local TV Stations

By Cynthia Littleton

LOS ANGELES (Variety.com) – Political advertising floods the airwaves every four years like clockwork. But this time around, two candidates alone — billionaires Mike Bloomberg and Tom Steyer — delivered an unprecedented $600 million gift to local TV stations during the past few months.

Bloomberg and Steyer together spent about $599.6 million in total TV advertising, according to Kantar/CMAG, which tracks political ad spending. That total includes coin shelled out for local spots on broadcast stations, cable and satellite TV platforms as well as national buys on broadcast and cable networks. The lion’s share of the spending flowed into the coffers of the largest broadcast groups with TV stations spread around the country, notably Nexstar Media, Sinclair Broadcast Group and Tegna.

“Broadcasters are definitely appreciative of the windfall they’ve had,” said Jason Wiese, senior VP and director of strategic insights for New York-based VAB, a trade association for media outlets that sell video-based advertising.

Bloomberg’s campaign accounted for $427.2 million of that $600 million, according to Kantar/CMAG. Bloomberg started his ad blitz in late November, according to ABC News’ FiveThirtyEight. Steyer began his campaign ad spending last July but it accelerated in December. Both candidates were self-funding their campaigns, although Steyer collected about $3.5 million from outside donors, according to the Center for Responsive Politics.

When spending on local radio spots and digital ads placed on Facebook and Google, the combined total for Bloomberg and Steyer jumps to $783 million, according to Kantar/CMAG. By contrast, spending on TV, radio and digital ads by all other Democratic presidential contenders to date is $186 million, according to Kantar/CMAG.

Sen. Bernie Sanders (I-Vt) led the charge for the non-billionaire bunch with $58 million in TV advertising commitments to date. Sanders spent some money on TV as early as last October but the volume stepped up in January and February, according to FiveThirtyEight.

With that level of spending, it’s no surprise that , the nation’s largest owner of TV stations, talked up the political ad gusher during its Feb. 26 earnings conference call. Nexstar chairman-CEO Perry Sook told investors that the company hit its goal for political advertising revenue in the current quarter as of Feb. 25, nearly five weeks before the end of the frame. In fact, Bloomberg’s campaign sucked up so many available spots that Nexstar believes it chased away other political ad buyers in the short term.

“As it relates to Bloomberg, it’s a good lead portion of our first-quarter money, but there’s some offset because we think there’s some candidate and PAC money that’s probably on the sidelines because of his spending right now,” Sook told investors on Feb. 26, a week before Bloomberg ended his campaign.

Bloomberg spent heavily in California ($67.6 million), Texas ($49.5 million), Florida ($40.9 million), New York ($23 million) and Pennsylvania ($20 million). He also plowed about $51.7 million into national spots, according to Kantar/CMAG. Bloomberg steered many millions into Super Tuesday states in an effort to generate momentum that he hoped would propel him to the top of the once-large Democratic field. The end of Bloomberg’s bid was undoubtedly a disappointment to broadcasters with stations in Michigan and Missouri, which hold primaries on March 10, and Florida, Illinois, Ohio and Arizona, which go to the polls on March 17.

, which owns 62 stations in 51 markets, benefited by having stations in states that shifted to earlier primary dates this year to be part of the Super Tuesday mix, including California and North Carolina.

“I think you’ll see first quarter will be more robust than in years past on a percentage basis but also on a just a true level spending basis,” said Tegna CEO Dave Lougee told investors on Feb. 11. “Even without Bloomberg, I think first quarter would be very, very strong. And so Bloomberg, obviously, has been additive to the primaries.”

Steyer also spent heavily on national spots ($66.1 million) and in his home state of California ($31.1 million). The former hedge fund executive dropped $20.3 million in South Carolina, where former Vice President Joe Biden got a huge bounce for his campaign after logging a commanding win. Biden took the Palmetto state with 48.4% of the vote compared to 19.9% for Sanders and 11.3% for Steyer. Per FiveThirtyEight, Biden spent about $720,000 on ads in South Carolina, a fraction of Steyer’s outlay. (Bloomberg was not on the South Carolina ballot.)

Neither Bloomberg nor Steyer generated enough traction in the 14 states that voted on Super Tuesday to justify staying in the game, even for candidates that had plenty of personal resources to continue. Wiese noted that the power and reach of TV advertising was nonetheless demonstrated by the fact that Bloomberg went from about 4% support in national polls at the start of his campaign to about 19% by the time he called it a wrap.

“When he entered the race he was a relative unknown to voters outside of New York,” Wiese said. The TV blitz “built him into a viable and credible candidate.”

Total campaign spending by Democratic candidates to date on broadcast and cable TV reached $729 million as of March 3. Issue-related spending by PACs and other non-campaign sources has topped $70 million, per Kantar/CMAG.

Total TV expenditures for the presidential campaign through the general election in November are expected to soar well past the $4.4 billion collected in 2016. The 2016 haul dropped considerably from 2012 ($5.4 billion) because spending by the Trump campaign was lower.

Wiese said broadcasters in California, Texas, Ohio, Illinois, Florida, Ohio, Pennsylvania and other large states are poised to see more political floodgates open as the year progresses. VAB is tracking about 65 races for Senate, House and gubernatorial posts that are expected to generate eye-popping amounts of ad spending.

“You’re going to have over 1,000 candidates campaigning,” Wiese said. “There is going to be huge money spent in the presidential election and also a huge amount of money on Senate and gubernatorial races.”

Nexstar’s Sook told investors on the earnings call that the Bloomberg effect on the early primaries was a welcome surprise, but the real windfall is still to come in the fall.

“The game is played in the two months before the November election,” Sook said. “That’s where 50% to 60% of our political revenue for the year will be realized.”

(Pictured: , )