Disney, Fox Set Shareholder Voting Date for $71 Billion Deal

By Cynthia Littleton

LOS ANGELES (Variety.com) – Disney and 21st Century Fox have set July 27 as the date for shareholder votes on ’s $71.3 billion acquisition of most of Fox’s assets.

Setting the shareholder vote puts a timeline in place for Comcast to respond with another bid, should the cable giant decide to continue its pursuit of Fox. Comcast declined to comment.

The separate shareholder meetings for Disney and Fox are set for 10 a.m. at the New York Hilton, according to Securities and Exchange Commission filings made Thursday by both companies.

Fox had previously planned to hold its shareholder vote on the acquisition on

July 10

. But Comcast’s decision to counter Disney’s offer with a $65 billion bid unveiled on June 13 forced Fox to postpone that vote.

On Wednesday,

Disney received approval for the proposed acquisition from the Justice Department. That removed a big hurdle to completing the buyout, and it gave Disney another leg up over Comcast in the hunt for Fox. Disney on June 20 responded to Comcast’s bid with a sweetened $71.3 billion offer that added nearly $20 billion in cash and stock to Disney’s original $52.4 billion pact set on

Dec. 14

.

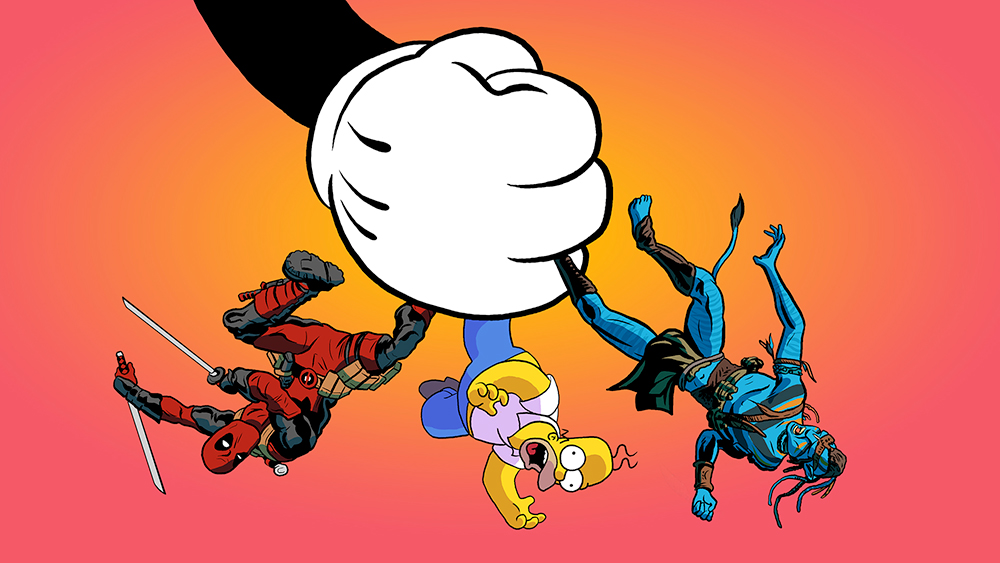

Disney and Comcast are vying for control of most of ’s film and TV assets, including the 20th Century Fox studio, FX Networks, National Geographic Partners and international operations including a clutch of 300-plus international channels, and Fox’s 30% stake in Hulu and 39% interest in Euro satcaster Sky.

To secure Justice Department approval of the deal, Disney agreed to divest Fox’s 22 regional sports networks. Anti-trust officials determined that the combination of those networks with Disney’s dominant ESPN national sports network could give Disney too much market power over sports teams and MVPD providers. Those channels are valued at about $19 billion.

The July 27 vote could conceivably be postponed again if Comcast comes forward with a sizable bid that requires more study and negotiations on the part of Fox’s board. But Disney has been moving forward as if the deal is a fait accompli given that Fox’s board has twice voted unanimously to endorse Disney’s offers. Disney also has the right to match any rival offers for Fox, which also advantages Disney in the high-stakes battle for the Fox assets that both companies see as vital to their ability to launch global direct-to-consumer streaming platforms in the future.