AT&T Getting ‘Tough’ on HBO? More Like Tough Love

By Andrew Wallenstein

LOS ANGELES (Variety.com) – When a conversation from a high-level internal meeting somehow makes its way into the press, that’s typically going to expose troubling news about the company involved. But in the curious case of a closed-door town hall last month between the new head of ’s content arm and 150 employees from its newly acquired division, HBO, the optics may be distorting reality.

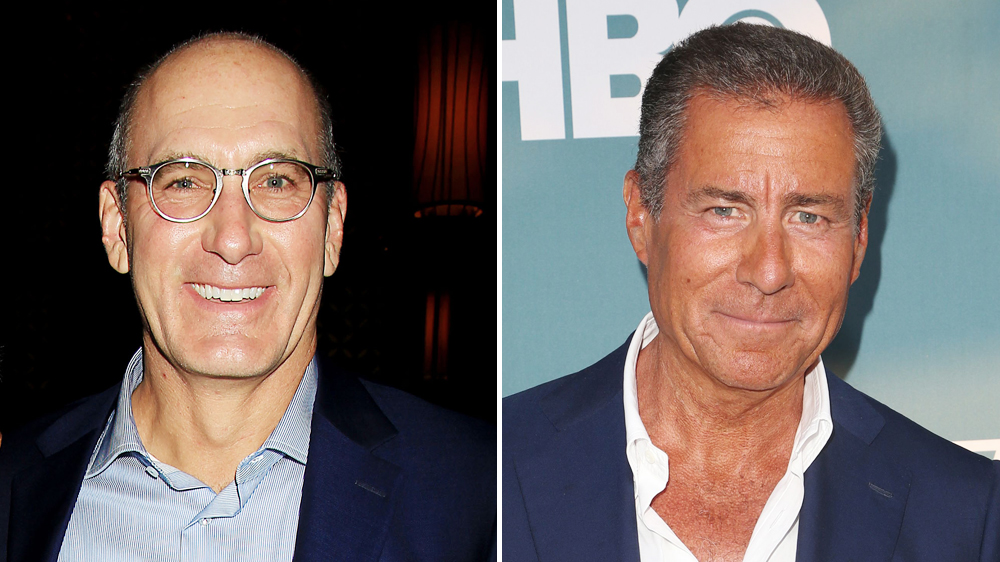

Granted, Monday’s New York Times report is not flattering to either WarnerMedia CEO John Stankey or CEO Richard Plepler. A conversation clearly not intended by its participants to be excerpted at length depicts Stankey talking about the crown jewel of the $85.4 billion acquisition AT&T just made as if it was an underperforming laggard in need of a dramatic shakeup. It’s sobering to hear Stankey tell Plepler in front of his own employees that 2018 is “going to be a tough year” for HBO and that the business needs to be more profitable and “change direction a little bit.” He even likens the work involved to childbirth.

Stankey probably wouldn’t have chosen that language had he not naively assumed what he said was going to stay in the room. As every self-respecting mogul learns, it’s safe to presume every conversation is going to leak, so conduct yourself accordingly.

What’s easy to lose sight of amid the controversial quotes is that Stankey is heard committing to increasing the programming investment that needs to be made in HBO in order to better prepare the brand to do battle with Netflix on a global basis. Everything else in the conversation is window dressing by comparison. (For a fuller account than The Times provides, Recode published a more detailed transcription.)

The table stakes HBO needs to play at a game in which Silicon Valley has significantly upped the ante is what the brand’s execs have been sweating over ever since AT&T declared its intent to acquire. Getting more than the $2 billion Time Warner currently allocates for HBO content costs is a matter of existential importance considering Netflix is spending at least four times that amount, and other streaming services like Amazon and Apple are fully capable of digging deeper into their own pockets.

Increased investment for HBO from AT&T wasn’t a sure thing; lesser companies could have attempted to cut their way to more profits, which would be the wrong call in this competitive environment.

But all this is really preamble to a much bigger question: Is HBO too boutique to get bigger?

More specifically, what’s unclear is whether the very attributes that make the brand so powerful to the consumers who pay for it — HBO’s high-brow, upmarket intelligence — provide a foundation on which to build into something that can draw a broader audience. It could be argued the brand presents impedes future growth because you can’t deliver high quality at high quantities.

Maybe what succeeded as a draw for a few hours of scripted TV on a Sunday night doesn’t work as well when the competition isn’t just Netflix on a wall-mounted flat screen, but a whole other class of apps like Twitter or Instagram battling for engagement time on AT&T’s mobile phones.

Throughout its 40-year history, HBO has been content to remain a top-shelf option to TV snobs willing to pay a little more for high-end programming. Now the game has changed; AT&T shouldn’t assume that HBO can make the jump from boutique to big box by simply pouring more money into programming — doing the same work, just more of that work.

I’s a seductive narrative because that strategy that essentially worked for Netflix, a free-spending first mover into the streaming space. But now that there’s plenty of competition in this category, second and third movers are going to need to think with a little more sophistication than just delivering content tonnage.

The companies that win the next chapter of the streaming arms race are going to have to look deep into their user data — AT&T should have plenty to share of that to share with HBO, it’s central to rationale for buying programming assets in the first place — and not just crank the programming engine faster for greater output, but be smarter about it. AT&T and HBO need to think hard about looking at the current viewing landscape — a fragmented, rapidly evolving mess — and plot surgical strikes to go big into the kinds of content where competitors are either weak or non-existent. Take news or sports programming, for example, where Netflix, Amazon and Hulu haven’t done much but HBO has already experimented plenty, including its Vice series.

Plepler probably already realizes this, but you can bet he’ll do his damndest to prove naysayers wrong. This is what excites him most: defying doubters of HBO’s future, which he’s encountered ever since he took the CEO job post-“The Sopranos” and many thought the network was past its prime. The skeptics were also wrong that there was much of a market for HBO outside pay TV, but getting more than 5 million subscribers to HBO Now over a few years is proof enough that no one really understands how much upside there is for HBO.

Don’t think for a second anyone at HBO is bemoaning the impending loss of its boutique status; these guys are hungry to scale up for for the fight against new rivals. Stankey may have looked like a hardliner by demanding HBO exceed 40% penetration of the pay-TV world but Plepler already publicly eyed the 50% barrier a few months ago.

Putting aside the gaffe of Stankey saying something he didn’t think was going to get out, what he said wasn’t strategically off base. You have a manager candidly setting expectations from the outset with the rank and file that they weren’t just continue doing the work like they’d always done in the Time Warner days. If anything, he notified a company with a lot of long-term employees that this might be a good time to jump ship if they were counting on business as usual going forward.

Yes, Stankey is implicitly critical of HBO in the town hall by suggesting the brand is not being engaged with by consumers on a daily basis as much as it could be. But as long as AT&T is indicating a willingness to give HBO the resources needed to bulk up, Plepler should be very happy.

But look to an underestimated component of HBO’s own current programming arsenal — boxing — for a good metaphor to understand where its new asset stands today. Stankey has basically just informed HBO it needs to train to fight at a heavier weight class. And as even the best boxers learn, it’s not as simple as just packing on the pounds.