Alibaba, T-Mobile Shares To Be Sold as Softbank Losses Approach $15 Billion

By Patrick Frater

LOS ANGELES (Variety.com) – Japanese tech investor, Softbank is poised to sell large chunks of its share stakes in T-Mobile U.S. and Chinese e-commerce giant Alibaba. Softbank revealed annual losses of $14.8 billion, including its share of the $18 billion losses at its Saudi-backed Vision fund in the financial year to the end of March.

The Vision Fund saw losses reach a combined $10 billion from its stakes in office hire firm WeWork, and ride hailing giant Uber. Both businesses were hurt by the economic impact of the coronavirus pandemic. The fund’s other investments in tech startups incurred $7.5 billion of losses. The fund, which previously targeted $100 million valuation, was valued at $69.6 billion at the end of March.

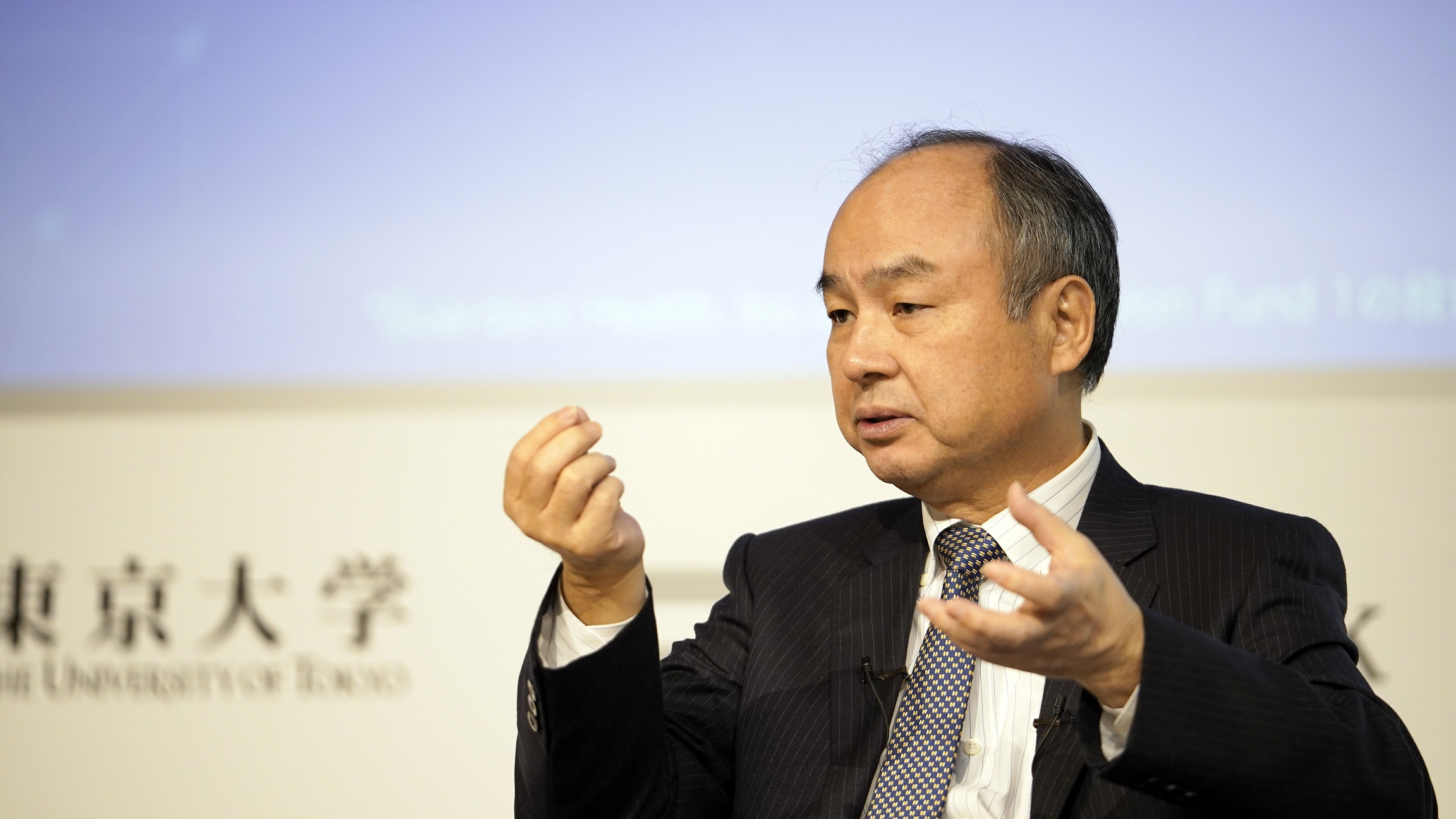

In order to fend off disgruntled shareholders, Softbank chairman Masayoshi Son said in March that the company would spend $4.7 billion buying back its own shares.

On Monday, Softbank said that it would raise $11.7 billion through the sale of some of its shares in Alibaba. Softbank was an early investor in Alibaba and became its largest shareholder, with a 24% stake at one point. Softbank booked an $11 billion pre-tax profit by selling some of its Alibaba shares in 2019.

Simultaneous with the latest stake sale news, Softbank said that Alibaba’s co-founder Jack Ma would cease to be a Softbank board director, from June, having served since 2007. Three new board members will be appointed.

The Wall Street Journal reported that Softbank will sell a substantial portion of its 25% stake in T-Mobile U.S. to T-Mobile’s parent company Deutsche Telekom. That would lift Deutsche Telekom’s stake in the U.S. cell phone company from 44% to over 50% and give it economic control, as well as the voting control that it already enjoys.

“The coronavirus is an unprecedented crisis,” said Son on Monday at an earnings presentation. He compared economic impact to the Great Depression of the 1930s and said that further pain was still to come. Unusually, Softbank did not recommend a dividend payment.