Wild Bunch Looks for Financial Rescue From German Shareholder (EXCLUSIVE)

By Elsa Keslassy

LOS ANGELES (Variety.com) – After months of searching for a white knight, Paris-based film group Wild Bunch is looking to be rescued by its biggest German shareholder, Lars Windhorst, who owns a controlling stake in the company via his investment fund Sapinda, Variety has learned.

Windhorst is in advanced negotiations to inject capital and to restructure ’s debt – which stood at €74.7 million ($86.5 million) as of mid-2017 – in a deal potentially worth €40 million to €50 million, according to several sources. The deal has yet to be approved by a Paris business court as part of Wild Bunch’s ongoing mediation procedure, which began last December and received an extension of deadline before the Cannes Film Festival.

Wild Bunch and Sapinda declined requests for comment Thursday.

Windhorst will have to prove that he has the financial resources to make the transaction in order for the deal to be sealed in mid-July, sources say. A colorful financier, Windhorst and Sapinda have been embroiled in several lawsuits over alleged failure to honor business agreements. Windhorst raised €500 million in a bond issue last September to help him settle outstanding suits and repay existing debts. His recent acquisitions include luxury Italian lingerie maker La Perla.

If the deal regarding Wild Bunch is not greenlit by the court, the company could go straight into bankruptcy. Its financial woes stand in stark contrast to its prestige on the festival circuit, which reached a peak last month in Cannes with four awards for Wild Bunch, including the Palme d’Or for Hirokazu Kore-eda’s “Shoplifters.” The firm also boasts a vast library of more than 2,000 films and direct distribution operations in France, Germany, Italy and Spain. But its market capitalization has hovered below €20 million for some time.

Wild Bunch, which hired private Paris bank Lazard nearly two years ago to look for financial solutions, has been unable to reach a deal with potential investors or a buyer to get out of its hole. Ironically, one of the reasons behind these difficulties is the control exercised by Windhorst, who has the ability to block other bidders, which he has done in the past, insiders say.

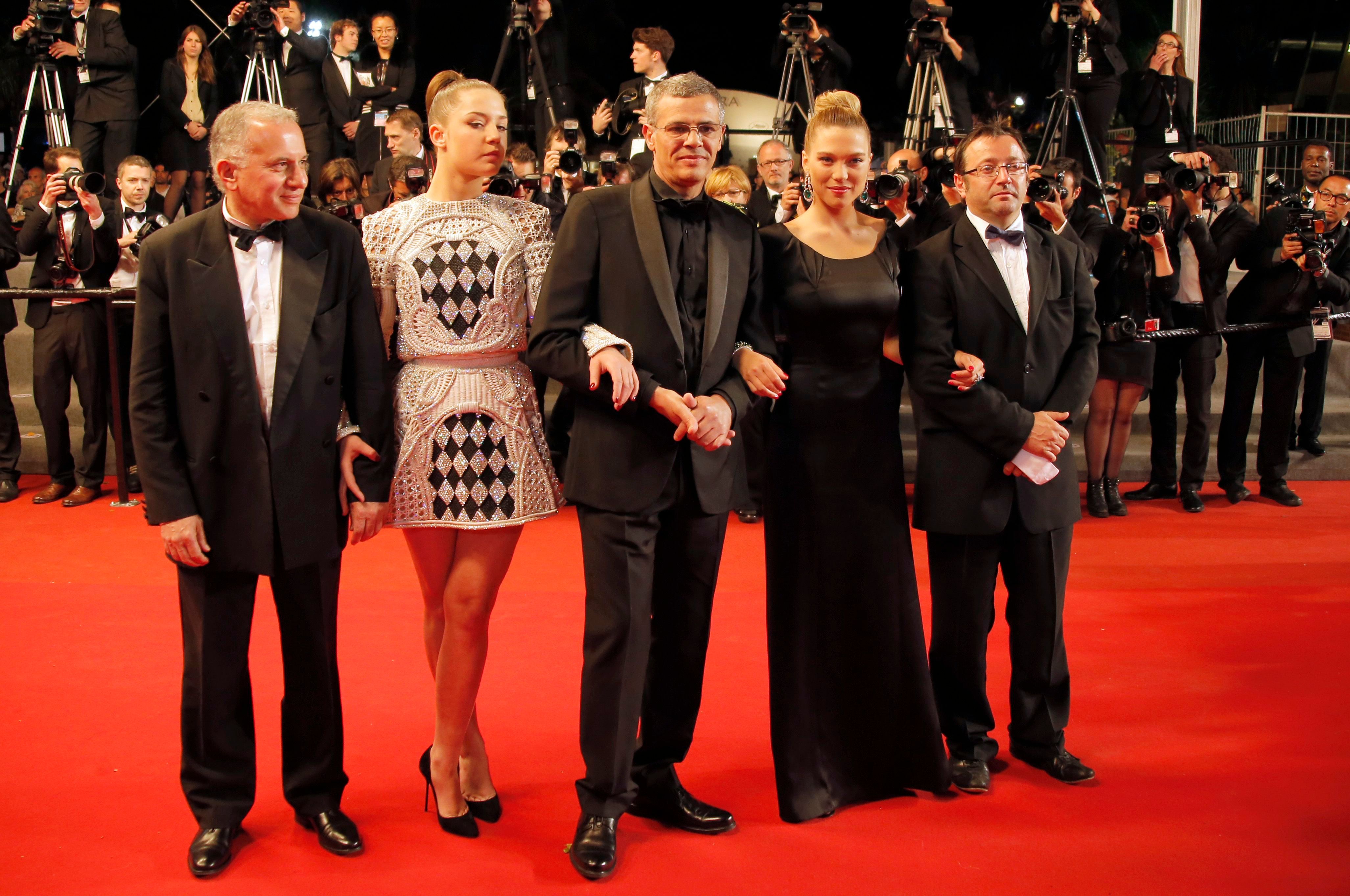

With Windhorst expected to play a larger role at Wild Bunch, what will happen to the well-established management team of Vincent Grimond, Brahim Chioua (pictured, on left), Max Sturm and Vincent Maraval is up in the air. Sources say Windhorst would probably want Maraval (pictured, on right) to stick around, as he is perceived as a crucial asset for the company because of his track record working with high-profile filmmakers, his taste in film acquisitions and his skills in international sales. But a shakeup at the top would not be out of the question.

Despite its troubles, Wild Bunch remains a champion of daring, unusual and politically minded indie films that are not easy to finance. The outfit’s loyalty to certain filmmakers has also been rewarded at festivals. On top of the Palme d’Or at this year’s Cannes, Wild Bunch also took home an honorary Palme d’Or for Jean-Luc Godard’s “The Image Book,” the Jury Prize for Nadine Labaki’s “Capernaum,” and the Directors’ Fortnight’s Art Cinema award for Gaspar Noe’s “Climax.”

Wild Bunch’s current sales slate includes the next projects by Ken Loach (“I, Daniel Blake”), Jean-Pierre and Luc Dardenne (“Two Days, One Night”), Arnaud Desplechin (“Ismael’s Ghosts”) and Kore-eda. The company is also a shareholder of Insiders, an L.A.-based sales company (“Under the Silver Lake”) launched by Maraval in 2015, which later became IMR following its partnership with Marc Butan’s MadRiver Pictures.