What’s Next for CBS-Viacom and Their Urge to Merge

By Brian Steinberg

LOS ANGELES (Variety.com) – Investors and media observers are hoping that Viacom and CBS will offer some hint of their progress this week toward a merger when the media companies each report their second quarter earnings on Aug. 8.

The two companies came to a tentative agreement last week about the management structure for the combined entity. Spokespeople for , and the Redstone family-controlled parent company National Amusements declined to comment on the status of any discussions the boards may be having about the expected merger. The move would recombine the companies after more than a decade apart.

But no matter how rigorous the companies’ preliminary discussions may be, there will be many more challenges to negotiate. Employees at both Viacom and CBS have expressed concern about the potential for layoffs, particularly on the television sides of their businesses. Analyst Michael Nathanson recently estimated a merged Viacom-CBS could find $500 million in cost synergies, but also noted “the lack of direct overlap in CBS’ and Viacom’s core operations leads us to believe the synergies could end up more limited.” CBS doesn’t operate a large movie studio or have any networks aimed at kids. Viacom has no direct tether to live sports or news.

And executives are already mulling the idea of using both companies’ assets to compete in the streaming-video arena, according to people familiar with the matter. A tie-up would give the new management team the ability to use a growing suite of CBS streaming-video products as well as Pluto, the ad-supported streaming portal that Viacom purchased in January for $340 million to jump into the fight for customers being waged among Netflix, Amazon and Hulu — and, soon, Disney, AT&T and Comcast.

The boards of both companies must also consider the true value of some of the companies’ traditional assets, including cable networks, in an era of cord-cutting and mobile video. One school of thought posits that a combined CBS and Viacom might still be too small at a time when Apple, Amazon and AT&T are shoving their way into the sector.

But a re-merged Viacom and CBS — the two were once part of the same company until controlling shareholder Sumner Redstone divided them in 2006, hoping for faster growth for two different piles of assets — would still be formidable. Tying the Viacom cable networks to CBS and Showtime would give the company more leverage with distributors. And a combined company would control more than 11% of major advertiser spending across all media types and more than 20% of all ad spending on national television, according to Standard Media Index, a tracker of ad spending.

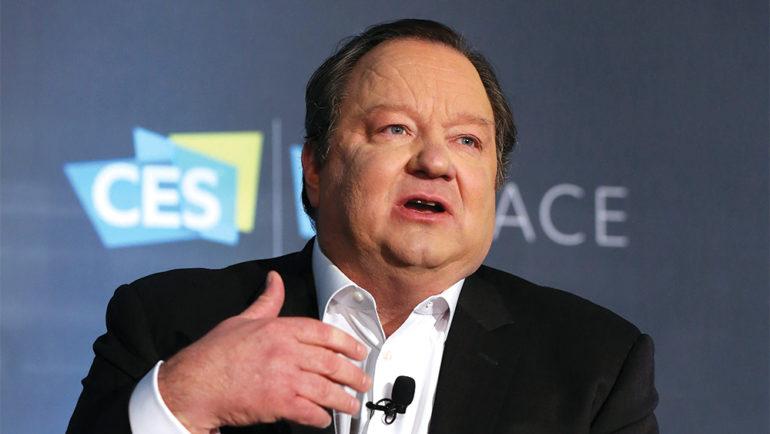

Under the new executive structure, Viacom CEO Bob Bakish is slated to take the reins of a merged entity that would operate a portfolio encompassing the CBS broadcast network, the Paramount movie studio and the Nickelodeon kids’ cable empire. Acting CBS CEO Joe Ianniello is being offered a position that would put him in charge of CBS-branded assets. Christina Spade, CBS’ chief financial officer, could become the CFO of the new company, informed people said, while Wade Davis, the Viacom CFO who holds larger responsibilities, is likely to depart; the companies are contemplating not having a chief operating officer role.

The focus on executive structure suggests the companies are being more methodical, perhaps, than some of their peers. Walt Disney Co. clearly had some senior positions in mind for some of the executives who joined as part of its recent acquisition of a large part of 21st Century Fox, but many rank-and-file Fox employees were left to wonder about their roles at their new employer.

People familiar with the Viacom-CBS talks caution that things remain fluid. A deal could ultimately hinge not only on agreements for executive structure but on pricing as well.

The two entities mulled combining in the recent past, without success; their corporate boards began examining the option again, this time spurred on not only by the departure last year of longtime CBS chief Leslie Moonves but also by consolidation in the industry. CBS and Viacom are smaller companies compared with Comcast; a newly expanded Walt Disney; and a WarnerMedia controlled by AT&T.

“Clearly, we’d like to see something on the table,” says Mario Gabelli, who controls a chunk of Viacom and CBS stocks through his company, Gamco Investors, in a brief interview. Nathanson, in a July research note, wrote: “Will they or won’t they? The CBS-Viacom merger saga has been dragging on for much of the past three years, and it feels like we may have some closure by the end of this summer.”