The Streaming Wars’ Other Battlefront: User Experience as Important as Content, Survey Finds

By Todd Spangler

LOS ANGELES (Variety.com) – Content is king — but the queen for direct-to-consumer streaming services is overall user experience, according to a new study.

It’s well understood that the price/value ratio for subscription VOD hinges on access to content, including exclusive originals and popular library titles. But just as important is an SVOD offering’s ease-of-use and other consumer-friendly features, consulting firm PwC found in a recent research survey.

On average, the correlation between content to value (with a 0.73 correlation coefficient) is roughly comparable to that of experience to value (0.70), according to ’s study.

“The biggest surprise to me was that the importance of the user experience, while not surpassing content, was as prevalent,” said Mark McCaffrey, PwC’s U.S. technology, media and telecommunications leader. “It’s stronger than I thought it would be.”

User experience (“UX”) has long been a focus for Netflix, the worldwide SVOD leader, as well as Amazon Prime Video and Hulu. Now the sector is about to get significant new competition from well-funded new entrants, including Disney’s Disney+, Apple TV+ and WarnerMedia’s forthcoming SVOD services.

And with the streaming market getting more crowded, McCaffrey said, “differentiation is becoming more imperative.”

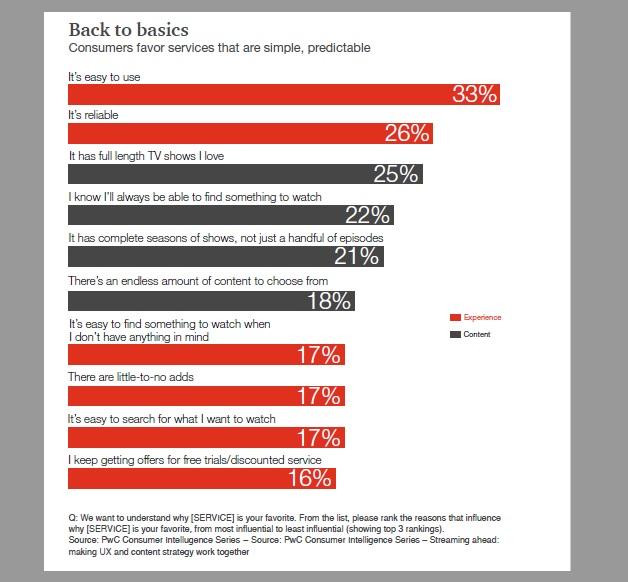

On the PwC-commissioned survey, when asked why a given SVOD service is their favorite, 33% of respondents picked “ease of use” among their top three criteria. That was followed by reliability (26%) and content-related factors — “It has full-length TV shows I love” (25%); “I know I’ll always be able to find something to watch” (22%); “It has complete seasons of shows, not just a handful of episodes” (21%); and “There’s an endless amount of content to choose from” (18%).

The results are based on a PwC online survey fielded in March 2019 to a nationally representative sample of 1,000 U.S. consumers 18-64 who have access to the internet.

Clearly, content is the carrot that drives subscriber signups: 36% of survey respondents said they have subscribed to a new video service expressly to watch a show that was exclusive to the service (and among those 18-29, nearly half — 46% — have done so).

Meanwhile, price point is a the single strongest indicator of whether a consumer keeps or cancels an SVOD provider: “Low monthly cost” was cited by 65% of respondents as among the most important features. That was followed by “little to no ads” (35%), an easy-to-use interface (25%), and binge-able full seasons of TV shows released all at once (24%).

But the quality of the UX is what drives overall retention, according to McCaffrey. “If you can improve the user experience, that tends to drive more loyalty in the customer base,” he said.

PwC’s survey found consumer usage of pay-TV and SVOD services to be similar — 58% said they watch subscription TV daily and 57% said they use subscription VOD daily. That’s followed by daily use of virtual pay TV services (25%) and ad-supported VOD services (20%). According to PwC, the frequency of daily use correlates with how users perceive convenience: Traditional pay-TV and SVOD services are much more likely to be viewed as “convenient” compared with vMVPDs and AVOD services.

Here are some of PwC’s other takeaways from the report, “Streaming ahead: Making UX + content strategy work together”:

- Usability and experience factor significantly more into subscriber retention than “loyalty” reward programs like monthly discounts on subscriptions or free trials.

- Letting users easily find exactly what they’re looking for is more important so than a casual browsing experience.

- Consumers do, however, want expanded browsing options, like being able to search by mood or length of content.