Cornucopia of Children’s Content Comes to Streaming Services

By Rob Owen

LOS ANGELES (Variety.com) – In the past decade broadcast networks mostly retreated to near the bare minimum of children’s programming that the Federal Communications Commission would allow. But in the past few months an influx of orders for kid-friendly content, specifically by streaming services, has made a seemingly cold genre suddenly hot.

In January, Hulu announced a revival of the popular “Animaniacs” for 2020 with a two-season, straight-to-series order. Amazon has been rolling out original children’s content for several years, most recently with the premiere of “The Dangerous Book for Boys,” a family series executive produced by Bryan Cranston. All the services mix original and acquired series. For Netflix that’s included such originals as “Julie’s Greenroom” and “Beat Bugs” mixed with acquisitions including “My Little Pony” and “The Cat in the Hat.”

“Streaming services are realizing for them to scale up their adoption they have to have a broad offering of services that appeal to everyone in the household,” says Steve Youngwood, COO and president of media and education at Sesame Workshop. “There’s no ambiguity that if kids and family is not an audience you serve, there’s going to be a limit to how many subscribers you’re ever going to have.”

While ad-supported, linear channels must satisfy advertisers with ratings, that’s not an issue for SVODs.

“These streaming services are in an on-demand world,” Youngwood says. “You don’t have the limitations of timeslots as opposed to TV channels that are going after a very specific audience.”

, which just a few years ago was retrenching, has more series in development since 2002 with the sale of three series — one animated, one puppet, one live-action — to Apple’s upcoming service.

“They’re all kid-focused, they all address a range of age groups of kids and felt like a great way to launch our partnership and for them to launch their service as they try to service kids and families,” says Youngwood. “This is high-quality, lasting programming that is not only entertaining, but also educational with the end goal of engaging but also impacting kids in a positive way.”

Sesame Workshop’s production ramped up with its 2015 deal to shift original episodes of “Sesame Street” from PBS to HBO (PBS gets free second-run rights of episodes nine months later). That deal, which runs through 2020, came a few months after the launch of HBO’s OTT service, HBO Now.

“The reason we thought HBO was a great partner is they had evolved even with [on-demand for subscribers service] HBO Go, saying people watch on linear, people watch on-demand, we want to make it as easy for consumers to watch however they want to watch,” Youngwood says. “And then the launch of HBO Now enabled people to get HBO who don’t subscribe to cable or satellite.”

“If kids and family is not an audience you serve, there’s going to be a limit to how many subscribers you’re ever going to have.”

Steve Youngwood

“Esme and Roy,” a Sesame Workshop series and its first animated show in more than a decade, debuts on HBO and its streaming platforms Aug. 18.

Kid vid writer-producer Angela Santomero, who has been called “the Shonda Rhimes of children’s television” and is the chief creative officer for 9 Story Media Group, has series on PBS (“Daniel Tiger’s Neighborhood,” “Super Why!”), Amazon (“Creative Galaxy,” “Wishenpoof”) and, beginning in early 2019, Netflix, with the premiere of “Charlie’s Colorforms City.” Her reboot of “Blue’s Clues,” which she co-created in 1996, debuts on Nickelodeon and its associated streaming platforms in 2019.

“What I’ve been finding [with streamers] is you can be a little more niche in the way in which you write, which is such a blessing for a creator in terms of not having to reach 6- to 11-year-olds because 6 and 11 are completely different,” she says, noting all the platforms share a goal.

“Each network or streaming content provider has their own specific vision in creating their brand, and what they’re known for and it’s constantly evolving. They’re always looking for their signature show.”

Therefore, Santomero believes, it’s a sellers’ market.

“I’m really finding everybody in the kids’ space right now, they’re looking for creator-driven talent to partner with,” Santomero says. “It’s a really good time right now for creators of kids’ media.”

PBS Kids has been at the forefront of streaming programming for children, launching a “Super Why!” app contemporaneous with the launch of Apple’s iPad in 2010 followed by a video app for iPad in 2011, about a year before Netflix debuted its first original scripted streaming series, 2012’s “Lilyhammer,” and well before Netflix, Amazon and Hulu began premiering original children’s series.

Lesli Rotenberg, PBS senior vice president and general manager for children’s media and education, attributes the uptick in appetite for children’s programming to the same desire for scale that galvanizes the creation of original content for all ages and demographics.

“With all this merger mania, there’s a war going on in terms of who’s going to be the last man standing when it comes to content providers and distributors,” she says. “For many of these companies, children are just the pawns in terms of reaching their ultimate goals, which are around numbers of subscribers and dollars and shareholders.”

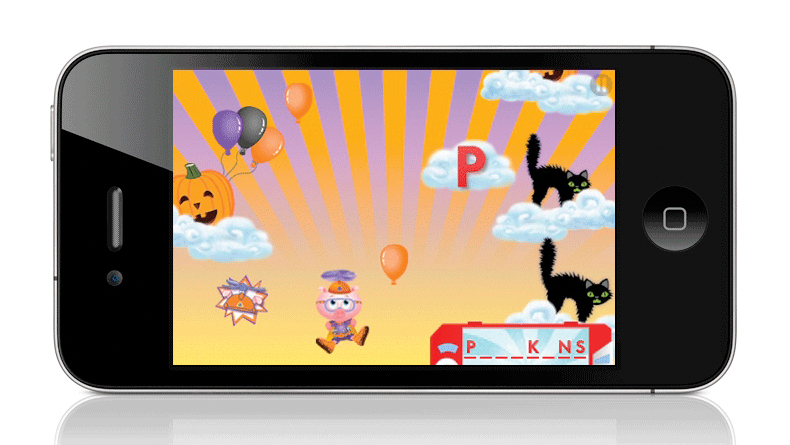

| PBS Kids’ “Super Why!” app uses classic carnival games to help kids ages 3-6 learn to read. Courtesy of PBS |

With its focus on children ages 2-8, PBS Kids, which in 2017 added a 24/7 over-the-air digital channel and app live stream and this summer expanded its free VOD offerings with multiple cable operators, has different objectives.

“We’re not measuring ourselves against them and we’re prioritizing different audiences,” Rotenberg says. “We’re focused on low-income and high-need populations. I don’t think any other player is looking at those audiences or caring if they have access to their platforms, which are not free for the most part.”

The competition for children’s talent isn’t affecting the development of programs for PBS Kids, Rotenberg says, noting the PBS Kids program development pipeline extends well beyond the next five years.

“We’re not having a challenge with f

inding talented producers,” she says. “Because more producers will be in this space, it gives us a wider pool of producers at a time we’re focused on diversifying our producer pool to make sure it reflects the audience we reach.

“In general the competition is a good thing,” she adds. “More content producers to create more content makes everyone better and provides more options for kids. This is a positive overall for the industry and children.”

Recent SVOD orders are not limited to younger children’s programming. Young adult-targeted content, aimed at teens and 20-somethings, have also proliferated, particularly following the success of Netflix’s “13 Reasons Why.”

In March Netflix acquired global rights to Awesomeness Films and Overbrook Entertainment’s “To All the Boys I’ve Loved Before,” a movie based on the best-selling novel by Jenny Han. In April Hulu gave a straight-to-series, 10-episode order for middle school comedy “PEN15,” featuring adult actresses playing 13-year-old outcasts while surrounded by actual 13 year olds. In June Amazon ordered three YA pilots, including “College,” executive produced by Jill Soloway and Channing Tatum.

“What everyone is seeing is that kids are loyal,” Santomero says. “They start watching one streaming service parents trust and respect and then they grow up with you. … It’s like when you get your first American Express card in college and then you stay with American Express forever. It’s that feeling. And it’s definitely that kids are a growing audience.”